Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then

Nuestras soluciones de Cooperativa que transforman los procesos de gestión de dinero, inversión y transacciones para nuestros clientes.

Ponte al día con las noticias y actividades e informaciones referentes tú Cooperativa.

Tú nueva página web con todas las información que necesita saber de tú Cooperativa.

Descrubre cómo tú Cooperativa ofrece valor a la comunidad del Jardín Botánico

El ahorro normal o aportes a capital debe ser equivalente al 2% del sueldo del socio. Es la contribución que debe realizar cada socio para constituir el capital de trabajo de la cooperativa.

Es un ahorro de carácter extraordinario que debe ser equivalente al 5% del sueldo del asociado y por el que se pagara un 6% anual El asociado podrá retirarlo siempre que no haya tomado préstamo especial.

A continuación le presentamos otros servicios disponibles para la comunidad del Jardín Botánico Nacional.

Make intelligent spending decisions as your business progresses through different growth phases.

Explore nuestras soluciones integrales de tú Cooperativa diseñadas para optimizar sus actividades financieras y mejorar su experiencia.

Este préstamo es mayor que, y hasta tres veces el Ahorro Normal, y se entrega en un plazo no mayor de treinta días y a un interés del 1.5%.

Este préstamo es el equivalente a cinco veces la suma del Ahorro Normal y el Ahorro Especial, siempre el socio haya depositado doce (12) cuotas ininterrumpidas.

Este préstamo tiene el propósito de facilitar a los socios adquirir su vivienda propia. Para ser elegible para este préstamo debe tener depositado en el Ahorro Normal.

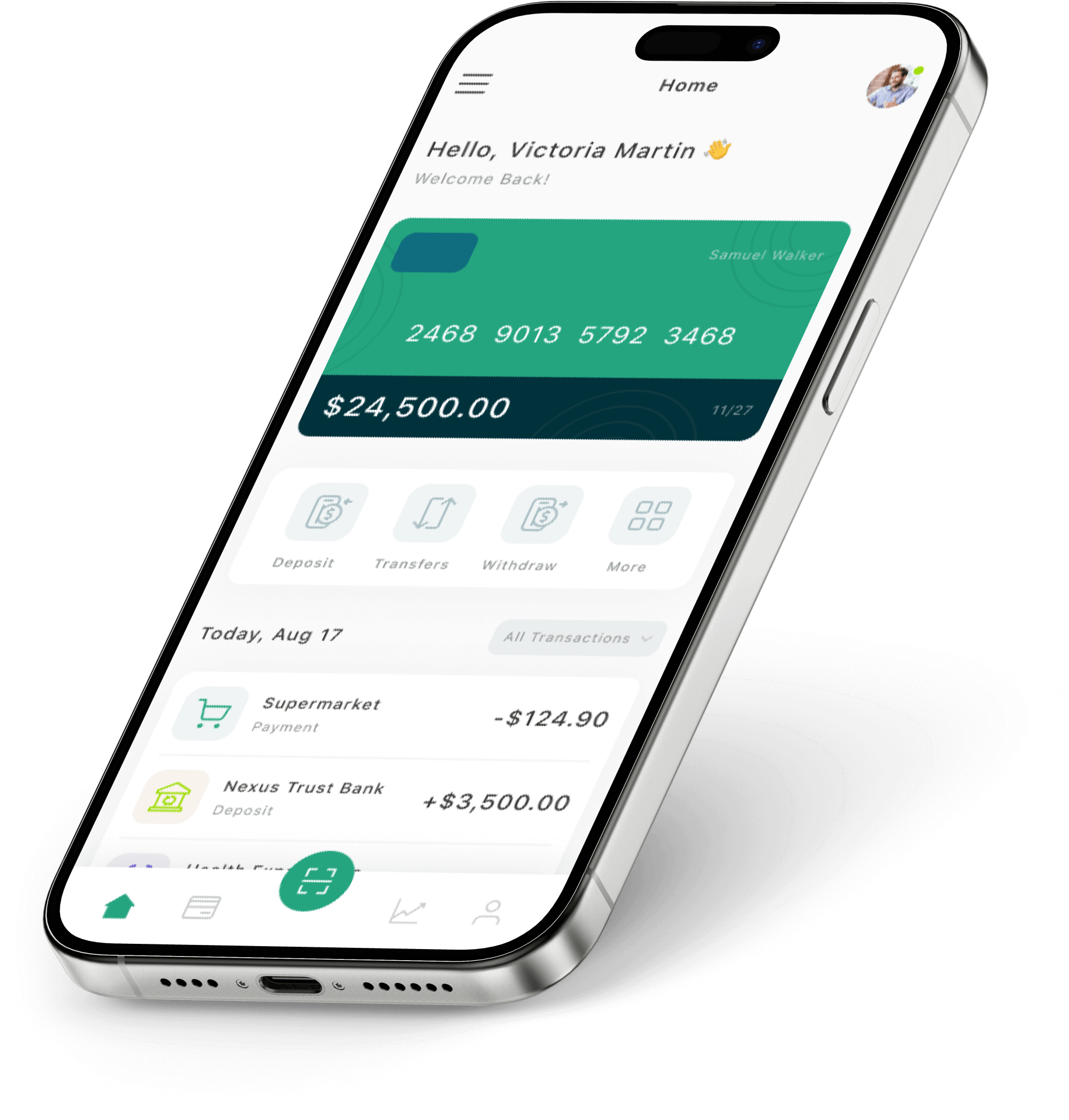

Experience transformative digital banking journeys with Finbank, revolutionizing financial experiences using advanced technology.

Entrepreneur

"As an entrepreneur, the fintech tools offered by this platform have revolutionized my operations, simplifying transactions and facilitating data-driven growth."

Tech-savvy User

"This platform's digital banking app is user-friendly and intuitive, providing easy access to financial data for effortless budgeting and saving."

Discover how modern technologies are changing finance, offering effective, secure solutions for everyone.

Fintech refers to innovative technologies and software that aim to improve and automate financial services, including banking, investing, payments, and insurance.

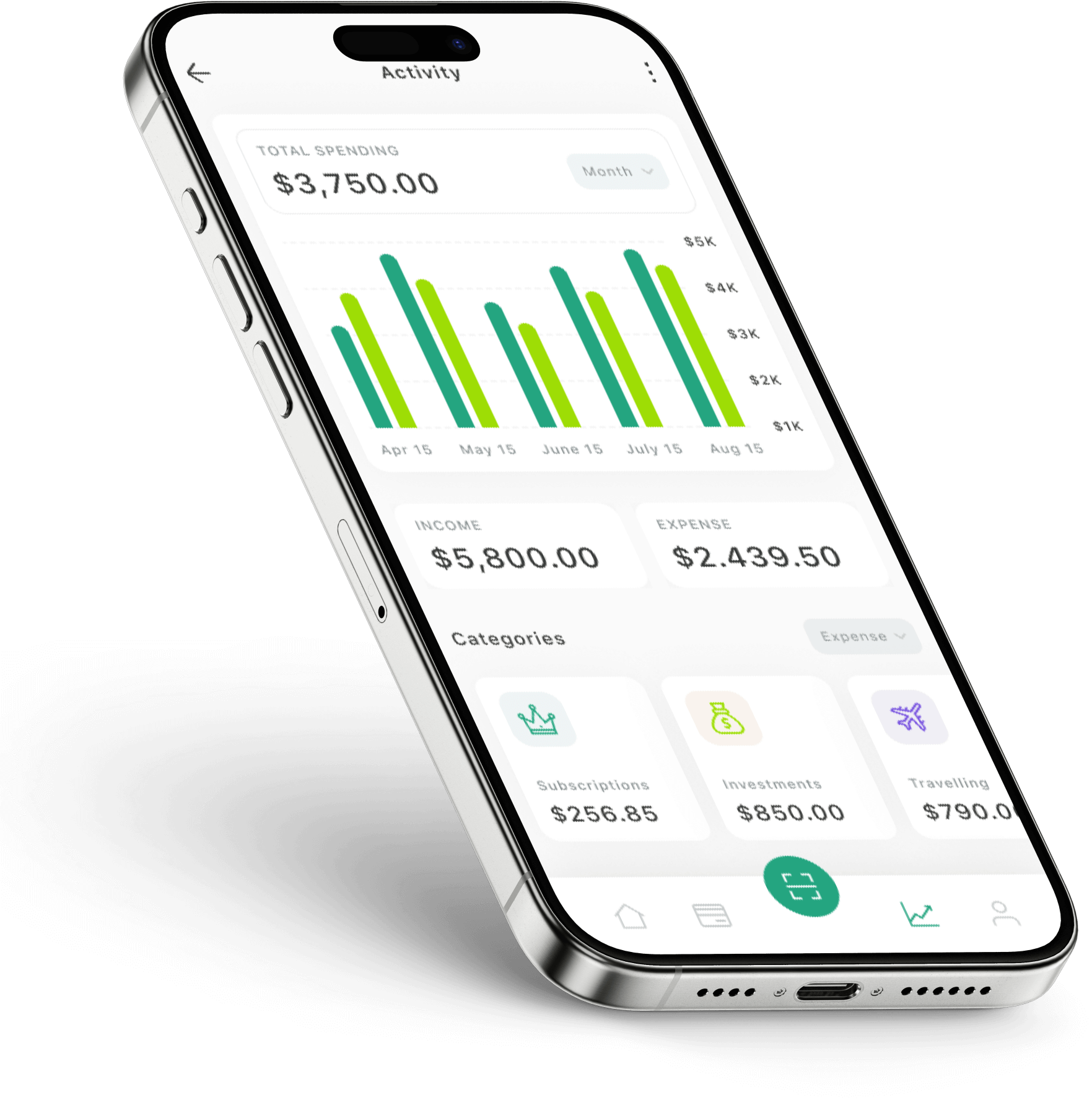

Fintech enhances convenience, accessibility, and efficiency for consumers by offering digital banking, mobile payment solutions, automated investing platforms, and personalized financial management tools.

Fintech applications include mobile payment apps, peer-to-peer lending platforms, robo-advisors for investment management, cryptocurrency exchanges, and Insurtech solutions for insurance processes automation.

Fintech offers a wide range of benefits, including faster and more convenient payment processing, access to alternative lending platforms, automated investment management, enhanced cybersecurity measures, and improved financial inclusion for underserved populations.

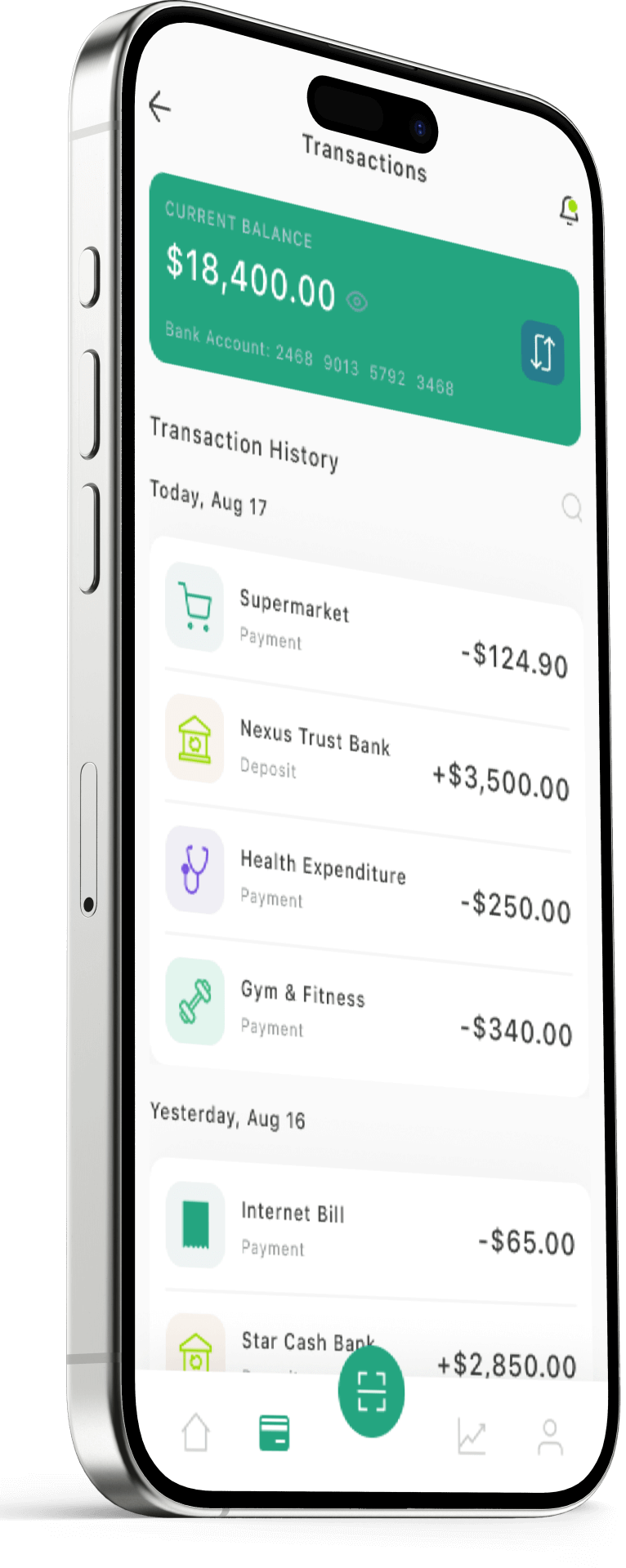

Our digital banking platform offers features such as account monitoring, fund transfers, bill payments, mobile check deposits, and secure messaging with customer support.

We utilize advanced encryption technologies and multifactor authentication to ensure the security and privacy of your financial information and transactions.

Simply visit our website or mobile app, fill out the required information, and follow the on-screen instructions to set up your account securely.

Where we navigate the evolving landscape of financial technology, digital banking solutions, and innovative payment systems.

Welcome to WordPress. This is your first post. Edit or delete it, then